-

“Leveraging the potential of renewable energy generation to attract the demand of these new investments represents a great opportunity for industrial growth in many regions of the country.” – Juan Francisco Caro, Director of Opina 360.

-

If energy generation shifts, industry could follow. The energy map shapes the industrial map: energy can exist without industry, but industry cannot exist without energy.

-

The question is not just how much renewable energy we can generate, but which regions will know how to turn this advantage into a new era of industrial prosperity.

Beyond political debates, there seems to be a broad consensus that Spain must redefine its industrial and energy map. A new map where reindustrialization advances hand in hand with renewables, with regions emerging as new growth hubs.

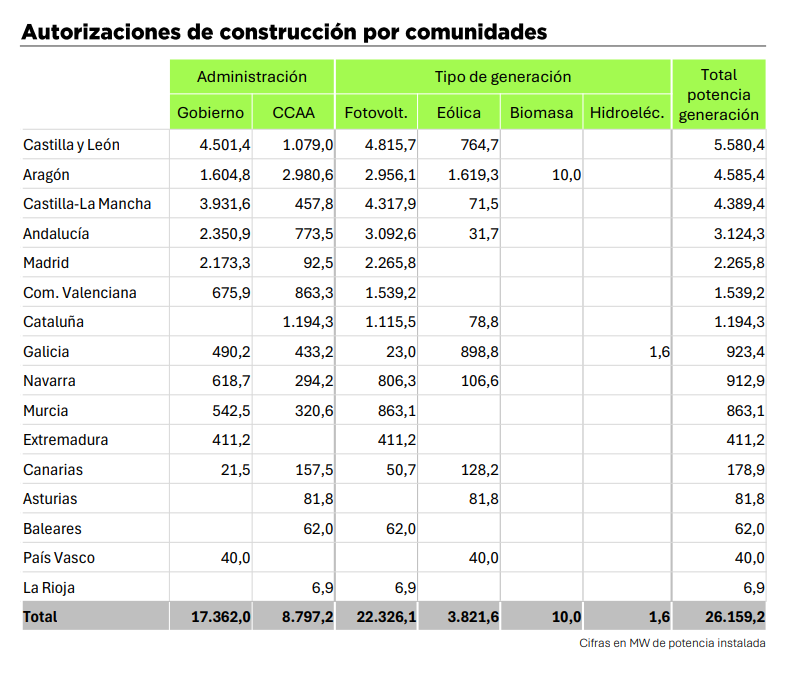

The report from the Renewable Energy Observatory of Foro Sella, prepared by Opina 360, provides us with a snapshot of 2024 in terms of renewable energy deployment. With 26,159 MW authorized—an overwhelming 85% allocated to solar PV—this analysis outlines the landscape on which the industrial development of the coming years could take shape. This is the starting point of a new journey, where the winds of the energy transition are blowing strong, yet challenges remain that could alter the course.

In this context, coordinates are being redrawn towards new territories where clean energy becomes a competitive advantage. Which regions have defined the new industrial development map in 2024, and how will this map evolve in the future?

Emerging Players Transform the 2024 Renewable Energy Map

The renewable energy rollout in 2024 has not been evenly distributed. Castilla y León (5,580.4 MW), Aragón (4,585.4 MW), and Castilla-La Mancha (4,389.4 MW) have become the main recipients of new capacity, absorbing more than half of the authorized projects. Madrid and Catalonia, traditionally less associated with solar PV, have begun to make progress in this technology, integrating into the new energy landscape. This shift is crucial to ensuring more balanced development and preventing an excessive concentration of activity in just a few regions.

“Renewables have proven this year, in regions like Aragón, that they are not only essential for achieving the decarbonization of the electrical system but also a key factor in attracting significant industrial projects. Harnessing the potential of renewable energy generation to meet the demand of these new investments represents a great opportunity for industrial growth in many parts of the country. This is why the regional debate on energy generation and consumption will soon begin: energy is consumed where it is generated,” highlights Juan Francisco Caro, Director of Opina 360. Thus, we see how renewables go beyond decarbonization and become magnets for industrial investment.

The availability of cheap and stable renewable energy is becoming a critical factor in attracting industrial investment. Energy-intensive sectors such as steelmaking, automotive, and chemicals seek to reduce costs and ensure a reliable supply to maintain competitiveness. In this context, the regions with the highest renewable energy penetration are emerging as the new focal points of industrial development.

Territorial Strategy and Storage: Key Elements for Balanced Industrial Growth

If energy generation shifts, industry could follow—but accompanying this process with a coherent industrial strategy will be crucial. The concentration of projects in a few regions could lead to imbalances, making territorial coordination an essential factor. Without a clear plan, growth could generate new inequalities and an excessive concentration of activity that disrupts economic development.

In 2024, 15,001 MW in projects were rejected, with 57% denied due to environmental concerns or permit expirations. Regulatory stability will play a key role in this scenario, as investors seek long-term security, and regulatory uncertainty could hinder the potential of the energy transition.

On the other hand, the lack of energy storage infrastructure remains a critical piece of the country’s energy puzzle. In 2024, 750 MW of storage capacity was authorized, with 600.6 MW concentrated in Castilla y León. This progress will impact emerging sectors such as data centers, whose energy demand continues to rise. However, the current storage capacity remains insufficient and requires significant investment to ensure a reliable and diversified supply. The evolution of storage solutions will be key to strengthening the industrial appeal of these regions and preventing renewable energy generation from becoming a double-edged sword.

Towards a New Energy Map: The Challenge of Balanced Development

“Spain must continue advancing at a high pace in renewable energy deployment if it wants to meet its ecological transition goals. That’s why it is crucial for regions that have lagged behind in deployment to catch up and join the overall trend,” warns Caro. But beyond energy generation, the real challenge is ensuring that this expansion translates into sustainable industrial development.

Because one thing is clear: the energy map shapes the industrial map. Energy can exist without industry, but industry cannot exist without energy. The key is to ensure that this process not only strengthens already consolidated regions but also enables balanced development across the country.

The energy transition is not a binary process of success or failure but a dynamic ecosystem requiring innovation, adaptability, and resilience. The 26,159 MW authorized in 2024 represent a starting point, not an endpoint. The question is not just how much renewable energy we can generate, but which regions will know how to turn this advantage into a new era of industrial prosperity.

2025 will be the year when we see how far this energy transformation reshapes the country’s economic future.